“Do we want to bet the company on this?”, CEO Zach Coelius asked his advertising tech startup Triggit when it got a shot to work with Facebook’s ad exchange. It took the chance, raised $7.4 million, and now FBX is performing 36% better than Google’s ad exchange, according to data Triggit released today showing it may have hit the jackpot. Triggit’s revenue is up 300% since it jacked into FBX.

For those less familiar, FBX is Facebook’s cookie-based retargeted ad system that launched in June 2011. It lets advertisers drop cookies on people who visit their site, say to look at a pair of shoes they might buy, then target them with ads on Facebook promoting those same shoes to get them to go through with the purchase.

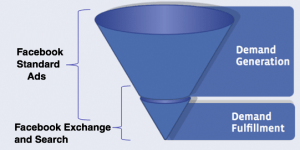

Retargeted ad exchanges like Google’s AdX have been around for awhile, and many advertisers have big retargeted ad budgets that Facebook wants to tap into. Some think FBX could become one of Facebook’s core revenue streams because retargeting lets it reach users who’ve shown purchase intent even better than search.

Advertising technology companies called demand side platforms work with advertisers and help them buy huge retargeted ad ampaigns. They collect cookies from advertisers so when one of their site visitors goes to publisher sites like Facebook, the DSP makes a real-time bid to show them a retargeted ad.

Triggit was in business for seven years working with Google, Rubicon, Admeld and other retargeting exchanges before FBX launched. It was nearing profitability thanks to scalable technology that let it buy billions of ads a month, and innovative features like the ability to scan an advertiser’s website and automatically turn into ad headlines and images.

When Coelius got the offer to be one of the first DSPs with access to FBX, he knew Triggit could leverage its technology to take advantage of the opportunity, but it had to work fast to get a head start. So despite the risk that users might hate retargeted ads on Facebook, Coelius tells me Triggit put “100% of its focus” on FBX. To accelerate development for FBX, in November Triggit raised a $7.4 million Series B led by Spark Capital and Foundry Group.

Triggit’s bet is panning out. By the end of November it had seen its revenue increase 300% in the five short months since it started working with FBX. And today it released a new set of stats indicating just how well Facebook Exchange is performing for advertisers. The data is even more convincing than a few stats from several DSPs that we published about early FBX trials in September. AdRoll saw 16X return on investment; TellApart saw a 6.65% click through rate compared to 6.41% on Google’s AdX; and Triggit got 4X higher profit, 2.2X higher post-click conversion rates, and 6.5X lower cost per click-through order than on other ad exchanges.

New Data Shows FBX Is A Winner

Based on six weeks of data about 76 million ad viewers, Triggit found that people are 240% more likely to a return to an advertiser’s site after they’re retargeted with ads for that site on Facebook. 60% of the time, people saw a retargeted ad on Facebook for a site they’d visited less than an hour ago thanks to incredible time-on-site and return visit frequency Facebook gets.

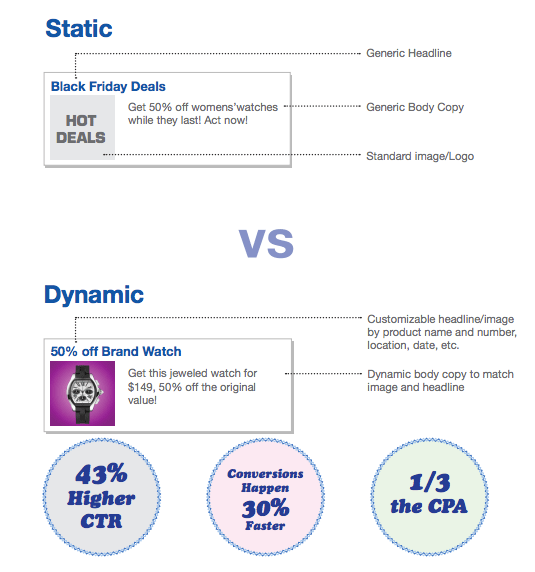

FBX ads are performing much better than standard, static Facebook sidebar ads. Retargeted ads with dynamic creative that relate to what a user browsed on an advertiser’s website got 43% high click through rates, delivered conversions for 1/3 of the price, and converted users 30% faster than static ads, according to two campaigns Triggit ran for a major online retailer.

Most interesting, though, is how Facebook Exchange stacks up against Google’s ad exchange and others. Triggit ran a campaign with half the ads purchased through Facebook Exchange and half on other exchanges including Google’s AdX, Rubicon, OpenX, and Pubmatic. Users who saw Facebook Exchange ads were 36% more likely to convert (for example, make a purchase) than users seeing the campaign on the established ad exchanges.

If FBX continues to perform better than competitors, it could suck up significant amounts of advertising spend, and turn into a huge money-maker for Facebook. In the meantime, it seems Triggit anchored itself to the right boat. It earns revenue on each ad it runs for its clients.

Coelius tells me the goal is to use retargeting to make ads actually relevant, and change the way the world perceives them. He says “Facebook has the power and the potential to make ads stop being bad and start being good, and make the people who are unhappy with advertising realize its not interruptive.” Instead, if FBX can show products people actually want to buy, ads can even be useful.

Advertising has gotten a bad wrap, but its actually the lifeblood of the consumer Internet. It lets everything from important communication utilities like Facebook to fun games become viable businesses. Coelius concludes that “If Triggit can get to where we can bankroll the Internet and make people happy. That’d be awesome.”

Check out my interview with Triggit CEO Zach Coelius below, and watch as we discuss how FBX could make an even bigger impact if Facebook opens it up for mobile advertising.

Triggit is an Advertising Technology company. We build technologies to make your ads work better. Targeting, Optimization, Yield.

Triggit is an Advertising Technology company. We build technologies to make your ads work better. Targeting, Optimization, Yield.

Source : feedproxy[dot]google[dot]com

No comments:

Post a Comment